Why Defining your ICP is So Critical

You're not going to scale as efficiently and effectively as you'd like until you have a tightly defined ICP. You probably already have the data to figure this out.

I was asked to help out the sales team at an early stage company. They had just hired two new AEs to focus on Enterprise selling, which they defined as companies greater than 5,000 employees because they had landed a fairly large customer and they felt that it was time to scale the business.

The AEs had success in previous companies and came with good references, but they weren’t driving much new business and the CEO felt that they might not be a good fit.

The CEO was trying to understand whether it was an issue with the AEs being a bad fit or if there was an issue with their GTM motion. He asked me to review a few calls, and to give my opinion and see what feedback I could provide.

Reviewing calls to do feedback

I listen to those calls and while I could tell they had some room for growth (like we all do), they knew what they were doing. I had trouble seeing how even one a top AE could be successful with the prospects on the calls I listened to. The product just wasn’t a great fit for these prospects. They had technical requirements that just weren’t supported.

When I shared this feedback to the CEO, I talked about how I didn’t think the prospects were a great fit. He said that these were large companies with good logos - exactly what they wanted. It seemed to me like he was basing this on company size so I asked him how they defined their ICP (Ideal Customer Profile). He said it was large companies who worked with some of the more modern DevOps tools but that was pretty much it. And the reason that those modern tools were included is because they didn’t have integrations with the more legacy tools that weren’t cloud based.

They also had a persona that they were going after. What was interesting about this persona was that if you had that role in your company, it usually meant you already had the technology or solution in place that they were trying to sell. Implicitly, this meant that they were trying to displace existing technology, which can be very difficult to do, especially if you don’t support all the technical requirements.

Building out an ICP

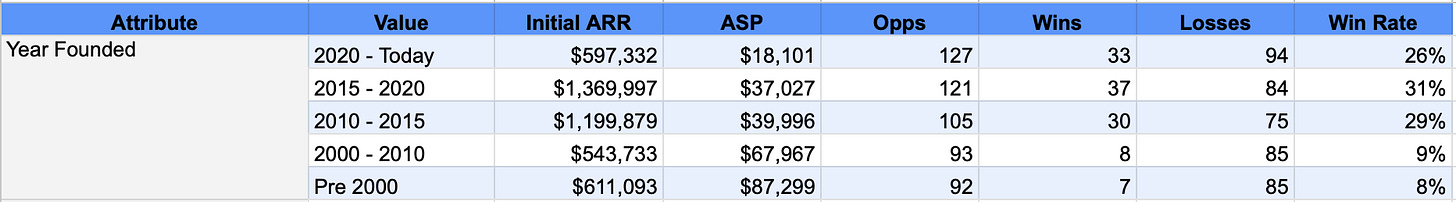

I suggested that we take a look at what their ICP should be based on their data. So I asked for information regarding all closed opportunities over time. For each one of these accounts, I also asked for employee count, industry, date founded, and other information about the technologies that they had (technographics).

Based on all this information, we could calculate a win rate, ARR, and ASP. Ideally I would also include net retention as well but this was a start.

You can see we categorized the attributes in the screenshot above. Some of these data points overlapped, some of it was missing, but it still gave us a pretty good picture of their profile.

They Shouldn’t Have Hired Enterprise AEs

(Note: Some of this data has been modified and/or blurred to protect their confidential information but it still directionally correct)

The first thing that jumped out was the difference for win rate based on company size. When they had an opportunity with a company with less than 1000 employees, the win rates were all north of 24%. But when they had an opportunity with a company greater than 1000 employees the win rate was single digits. And remember that they defined Enterprise as greater than 5000 employees.

The other big data point that jumped out was the year that the company was founded. Almost 90% of their customers were founded after 2010.

These two data points were correlated and it made sense when we thought about it. As I mention earlier, their product only worked with more modern DevOps solutions that have been around for less than 15 years. Companies founded before 2010 didn’t have those tools yet as an option so they had to use some older technology that the product didn’t support yet. Company size also matters because most companies founded in the last 10 to 15 years are usually not over 1000 employees. There were plenty of exceptions to this, but the odds were against them.

Focus on your ICP and then expand

One of the more interesting points that came out of this is that there was a cohort of their customers who met all of the attributes of the ICP, including some of the technographics. Whenever they had an opportunity with one of those prospects who checked every single box they had a greater than 50% chance of winning that opportunity. That meant that all outbound efforts should go into finding these prospects to create a consistent and scalable GTM.

One of your primary jobs as the leader of an early stage company is to find GTM Fit. When you do that, you are able to fund growth to get to your next milestones. It can be tempting to chase every type of opportunity that comes your way and to go whale hunting. What you really want to is to look for some sort of niche, which is essentially your ICP, that you can consistently find and close business on. This creates positive momentum, makes the business more efficient, and allows you to improve the product.

By no means does this mean avoiding companies that don’t fit in your ICP. When those opportunities come to you, have a decision making framework in place to determine how to handle. Maybe it’s presence of budget and a clear path to winning based on your characteristics.

Those companies just outside your ICP that you land will be next set of customers that you target.